Expense Tracking Tools can help you streamline your financial management even when inactive throughout the operation. An employer always wants to stay current with all expenses and avoid going through crumbled receipts or email chains.

On the other hand, the employees would always like to report expenses quickly and get reimbursed on time. Having an expense tracking tool can be very helpful and streamline the entire management process effectively.

These tools will be very helpful in measuring and giving a complete overview of the business’s health. Whether you are a small business owner or managing a giant employee boss, you should know about these expense-tracking tools to manage your business.

Best Expense Tracking Tools

These are some of the best expense-tracking tools for small businesses:

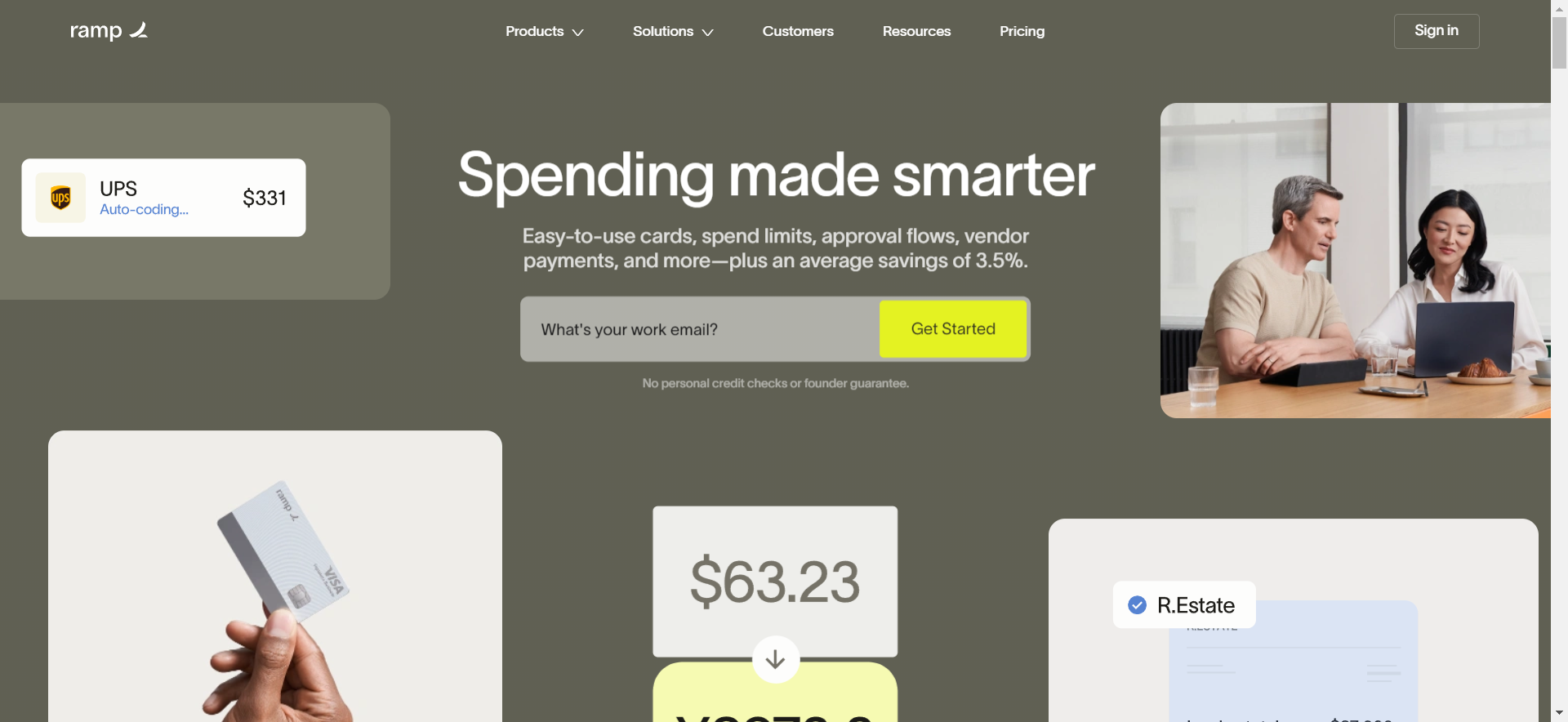

1. Ramp

Ramp is a popular business credit card and spending management platform allowing small businesses to streamline automation and other business spending. It is a 5-in-1 expense tracking tool that will help save precious time by managing bill payments, expense management, corporate cards, accounting, etc.

It is not just limited to automating expense tracking but also manages bookkeeping faster with automated reconciliation. The tool can also integrate with more than 100 apps, which include Slack, Xero, Google, Quickbooks, etc.

Features

- Corporate Cards: Ramp facilitates virtual and branded physical cards for employee and travel expenditures.

- Expense Management: Employ customizable restrictions and utilize AI-driven receipt matching for streamlined reimbursement.

- Bill Payments: Automate accounts payable and multi-level approvals with AI-enhanced invoice processing.

- Accounting Automation: Real-time transaction sync and swift accounting integrations for enhanced efficiency.

- Real-time Reporting: AI-powered recommendations to curtail out-of-policy spending, leading to potential savings.

Pros:

- Streamlines small business operations.

- Reduces business spending.

- Comprehensive 5-in-1 spend management.

- Automates corporate cards, expenses, bills, accounting, and reporting.

- Accelerates expense tracking and bookkeeping.

- Offers integration with over 100 apps.

Cons:

- It might have a learning curve for some users.

- Advanced features could lead to complexity for tiny businesses.

- Integration setup might require technical expertise.

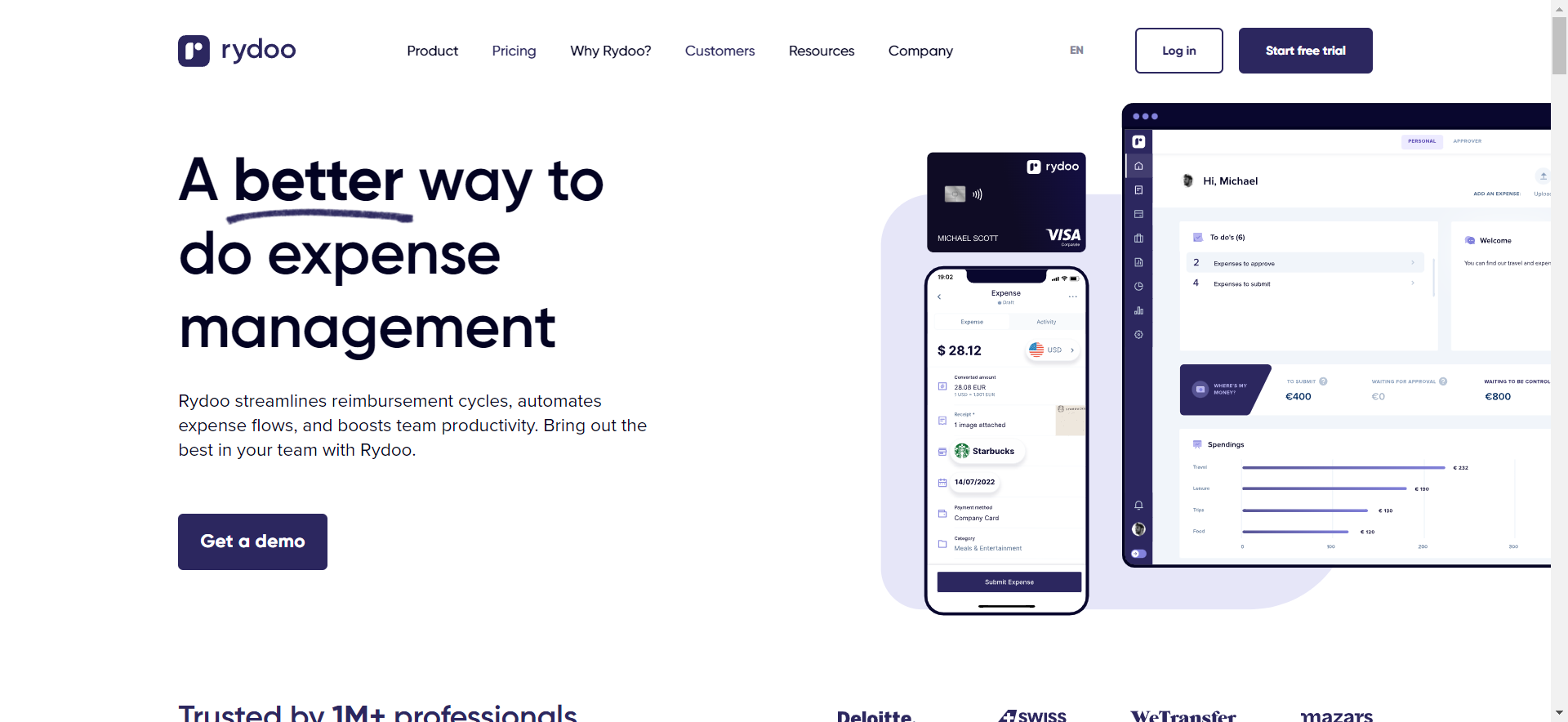

2. Rydoo

Rydoo is another expense management tool that will help you improve financial forecasting and analysis while avoiding all the headaches of your finance team. It is a small tool to help you centralize employee receipts and track expenses and per-diems.

This tool lets you quickly improve your cash flow, reimbursement cycles, and compliance.

Features

- Reduce spend approval workload with out-of-policy expense warnings and automated expense approval through Rydoo.

- Identify bottlenecks, forecast expenses, and uncover cost-saving opportunities using pre-designed employee and project dashboards.

- Minimize manual workload by setting default jurisdiction rates or custom daily allowance rates for seamless adherence to local regulations.

- Integrate mileage tracking through Rydoo’s map service, enabling employees to create and manage trips in real-time.

- Convert employee receipts into searchable critical data swiftly, facilitating anomaly detection and data usability.

Pros

- Rydoo improves finance forecasting and analysis, aiding in better financial planning.

- Centralize employee receipts for easy tracking and organized expense management.

- Track mileage expenses seamlessly with integrated map services.

- Keep tabs on per diem allowances effortlessly.

Cons

- Integrating with existing systems might pose some challenges for setup.

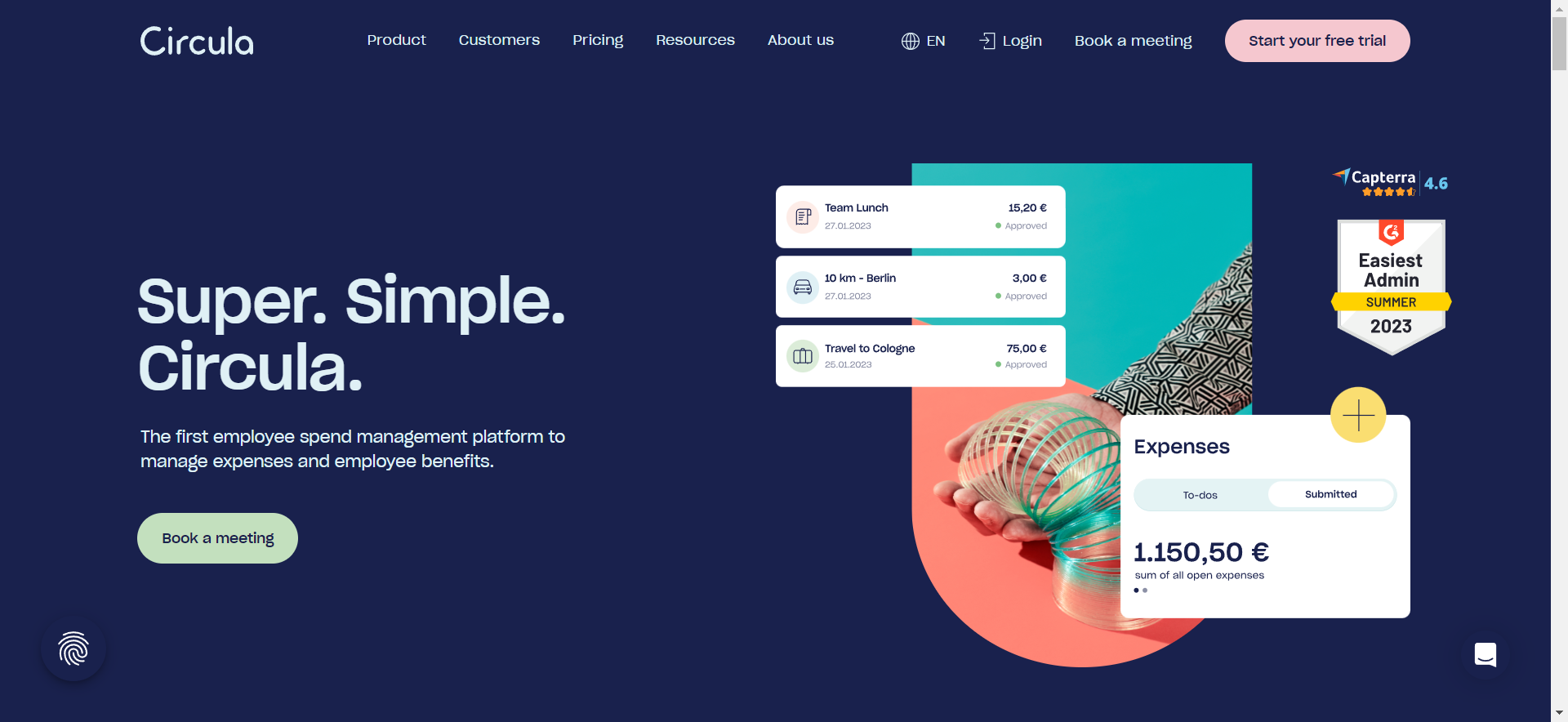

3. Circula

Circula is a popular finance platform to help you manage employee expenses and corporate benefits. The app is designed to keep your small business compliant and free from irrelevant expenses.

Circula also has an AI automation feature that helps expense management and policy automation. Moreover, you can also integrate ERP systems, HR, and payroll solutions as well. So, it will be very convenient to smoother business processes.

Features

- Streamline administration tasks with Circula’s tax-optimized receipt control solution.

- Empower employees by creating and overseeing physical and virtual credit cards.

- Incentivize employees with a suite of tax-optimized benefits.

- Implement a simple, cost-effective, and easy-to-configure solution.

Pros

- Expense and Benefits Management: Effectively handle employee expenses and corporate benefits.

- Compliance: Ensures small businesses remain compliant and avoid unnecessary expenses.

- AI Automation: AI-driven automation enhances expense management and policy adherence.

- Integration: Seamlessly integrate with ERP, HR, and payroll systems for enhanced efficiency.

Cons

- Learning Curve: New users might require time to fully grasp the platform’s features.

- Complex Needs: This may not cater to highly complex financial operations.

4. Divvy

Divvy is one of the best expense management tools available for free. It will help you in managing both business purchases and spending. It has an account payable automation feature, simplifying payment approval and two-way data sync.

Apart from all these features, Divvy also protects your business finance data with industry-leading standards such as PCI DSS and SOC2 Type 1.

Features

- Manage online subscriptions and purchases using unique cards.

- Divvy’s process streamlines reimbursement management for small businesses.

- Earn weekly, semi-monthly, and monthly rewards by making frequent payments through Divvy.

- Ideal for companies seeking a credit line with a simple online application.

- Seamlessly integrate with popular software solutions like QuickBooks and Oracle NetSuite.

Pros

- Cost-Free: Available as a free expense management tool.

- Comprehensive Management: Efficiently manage business purchases and spending.

- Payment Automation: Features account payable automation for streamlined payment approval.

- Data Sync: Simplifies two-way data synchronization for accuracy.

Cons

- Feature Limitations: Some advanced features might be limited in the free version.

- Learning Curve: New users could require time to understand all functionalities fully.

5. Payhawk

Payhawk is all-in-one finance software that will help automate and manage banking and accounting needs. The software has something for every business type, including bill payments and accounting information.

Moreover, you can integrate this software with ERP systems, including Xero, Quickbooks, Oracle NetSuite, and Datev.

Features

- Automate payments using Payhawk’s dedicated IBANs.

- Enhance employee experience with one-click approvals and reimbursements.

- Digitize invoice data extraction and reconciliation.

- Obtain both physical and virtual Visa commercial cards.

Pros

- Comprehensive Finance Software: Offers an all-in-one solution for banking and accounting automation.

- Versatile: Suitable for various business types, addressing bill payments to accounting needs.

- Integration: Easily integrates with popular ERP systems like Xero, QuickBooks, Oracle NetSuite, and Datev.

Cons:

- Learning Curve: New users need time to fully explore and utilize all software features.

- Complexity for Smaller Businesses: Smaller businesses with more straightforward needs might find it more comprehensive than necessary.

Final Words

These are some of the best expense-tracking tools for all business types. It can help make financial management smoother with advanced tracking and automation techniques. If you want to streamline business operations smoothly and seamlessly, these tools can be the best choice for consideration.